Tax Deductions for Seniors

May 31, 2022

Deducting Education Expenses

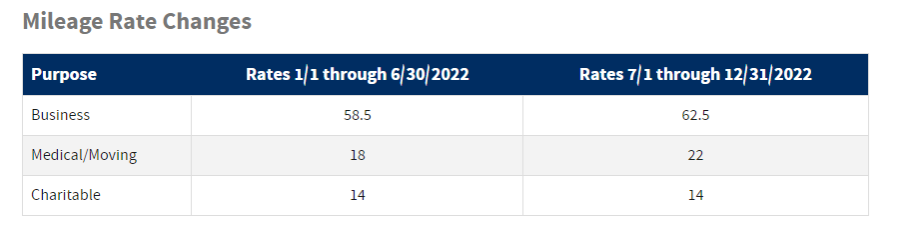

July 28, 2022On June 9, the IRS announced an increase in the optional standard mileage rate for the final 6 months of 2022. While the IRS normally updates the mileage rates once a year in the fall for the next calendar year, this special mid-year change was prompted by the rapidly rising gas prices. Adjusted rates will be used to calculate tax deductions for the use of an automobile (i.e., a car, pickup truck, or van) for business, medical, and certain moving expenses for July 1 to December 31, 2022.

The mileage rate isn’t just determined by fuel costs. Depreciation and insurance and other fixed and variable costs are also entered into the calculation. And as always, self-employed taxpayers can opt to calculate the actual costs of using their vehicle rather than using the standard mileage rates. With that option, taxpayers should add up all car-related expenses for the year (i.e., gas, oil, tires, repairs, parking, tolls, insurance, registration, lease payments, depreciation) and multiply the total by the percentage of total miles driven that year for business reasons.

While mileage rates for business and medical/moving purposes both increased $0.04 per mile, the charitable rate remains unchanged at $0.14 per mile. Costs associated with driving your car for charity can be deducted, and just like other car-related expenses, taxpayers can choose to use the standard mileage rate or calculate the deduction by actual costs.

Please refer to the following table to review the updated standard mileage rates, which become effective July 1, 2022. If you have any questions, our team at Anderson, Adkins & Company is ready to help.