Historic Income Tax Cut with Georgia State Tax Laws Changes

March 16, 2022

Tax Deductions for Seniors

May 31, 2022It’s important to know how long to keep tax documents, while also avoiding risk of fraud or identity theft but keeping sensitive documents accessible. Here are three ways to keep your documents secure:

1. Safety store your documents.

For physical documents, protect your paper records from damage or theft by storing them in a designated, safe spot in your home or office. Digital records should be archived, electronically backed-up and protected with a password.

2. Protect your financial accounts.

Use unique and complex passwords that are changed often and different than your personal email or social media accounts. Antivirus software can also protect your electronic devices and accounts.

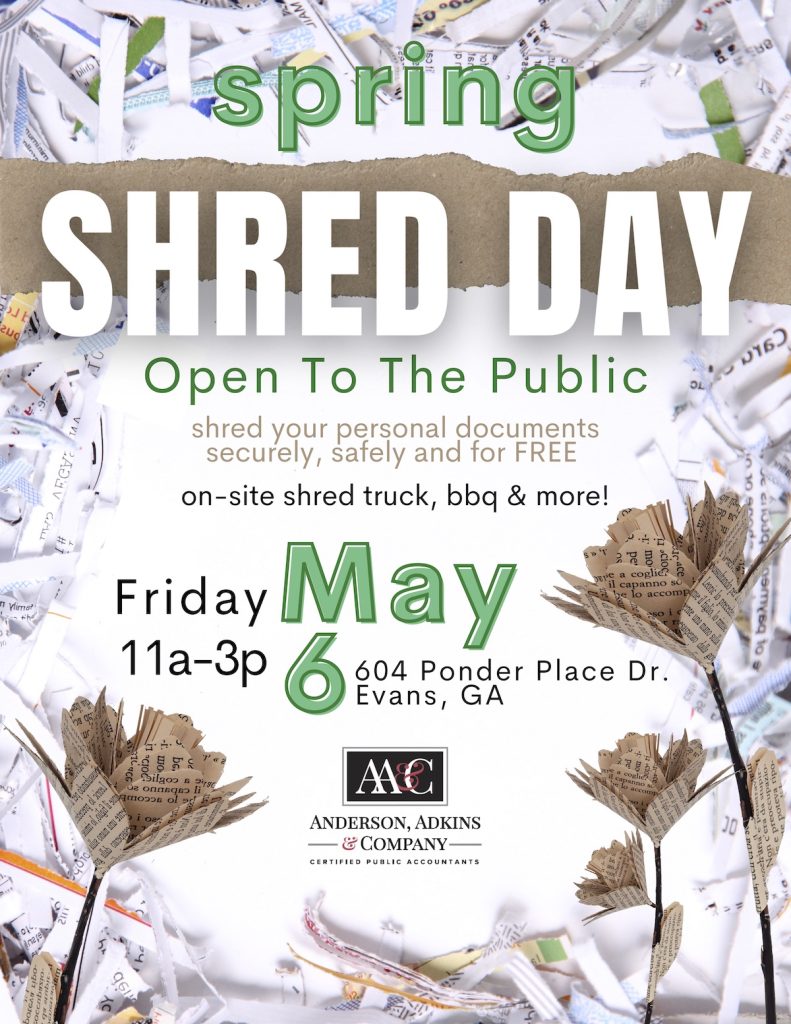

3. Safely dispose of physical documents.

Simply throwing away paper documents with personal and financial account information can put you at risk for fraud or identity theft. Shredding can be done at home with a personal shredding device, but an easy and free way to safely dispose of documents is at an on-site shredding event, such as the one that we are hosting at the Anderson, Adkins & Company office on May 6. This event is open to the public and free to shred your personal documents securely and safely.

Not sure what to shred or keep? Here are a few guidelines:

The Internal Revenue Service requires record retention as long as your return is open under the statute of limitations. Generally, the statute of limitations is:

- 3 years from the date the return was filed, or

- 2 years from the date the tax payment was made, or

- 6 years if income is under reported by more than 25%

Keep all bank statements, checks, receipts, and other financial records for at least 3 years (previously 6 years,) especially those documents that will support your tax return(s) including Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receipts.

Hold indefinitely:

- All papers and receipts that deal with any purchase, sale and major improvement of your investment and real property.

- The supporting documentation and 1040 returns filed for each year you make a non-deductible individual retirement account contribution with after-tax dollars.